Implementing a mobile app payment gateway requires considering some essential moments to help your integration work properly. This post will reveal your payment gateway comparison as well as recommendations on how to integrate the payment gateway in your app and more essentials.

How to Integrate Mobile App Payment Gateway in 2022 and Succeed: Things to Consider

Credit cards completely changed our everyday lives and made us stick to them, as it's quite easy to spend large sums of money from 2.8 billion of these plastic pieces used around the world. Such payment method has spread to websites and mobile solutions.

This post will tell you how to integrate mobile payment gateways into your apps and succeed. Moreover, you'll get to know about gateway comparison characteristics, the most well-known payment gateways, and other essentials.

The Meaning of Payment Gateways

A gateway for payment is an intermediary between the money transaction performed by a client and a payment provider (e.g., financial institution). Intermediaries are essential to make the interaction between solutions and the payment systems more secure.

Gateways are perfect for companies who need to use payment alternatives for their apps without being responsible for customers' data security. The payment gateways function as app components encrypting sensitive data to provide secure mobile app payment processing.

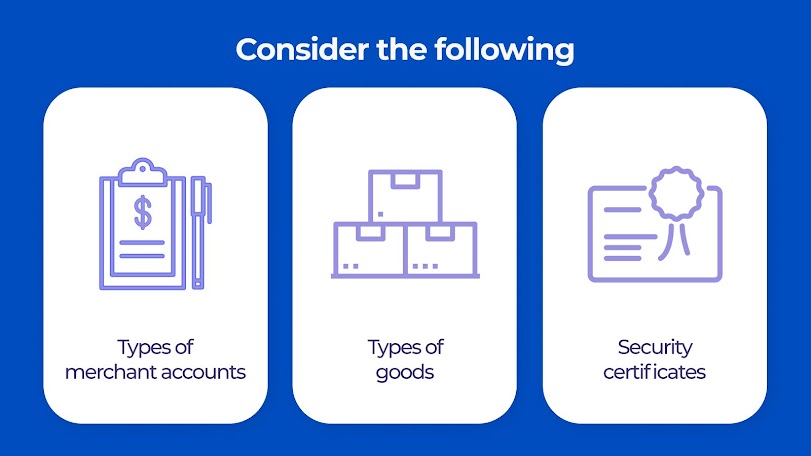

Things You Should Consider

Implementing debit and credit card payment requires considering some essential moments to help your integration work properly. Let’s delve into these moments.

Merchant Accounts Classification

Merchant accounts function as your organization's online bank ones validating the payments you obtain via the Internet. They keep the money you earn from app sales for a short time (usually 2-7 days) before transferring it to your company bank account.

The merchant account can be created with bank support and connected to the payment gateways, letting their customers use primary online transaction and security features. Another alternative is to employ one of the card payment gateway providers, including an all-in-one solution for clients and handling merchant accounts (e.g., PayPal and Stripe).

According to your business requirements, you should make your choice between the following types of merchant accounts:

A dedicated merchant account for your company has many advantages concerning your finance control. For instance, increased speed for money transfers (up to 3 days vs. 2-7 days for other account types) and more flexibility for financial activities such as account debiting, transaction mistake repair, etc., facilitate your payment processing. Moreover, you can use separate tariffs that depend on your sales frequency.

But keep in mind that the dedicated merchant account is an expensive and time-consuming option: your resources will mostly be spent on various checks (e.g., the security one).

An aggregate merchant account is a common bank сell for several clients. This type of merchant account considers less financial control over your funds because your company income is shared with one of the other organizations.

Finance withdrawal to your company account may take more time than usual due to the above-said. However, this alternative is more resource-saving than the previous one.

Kinds of Goods You Sell

The products offered through your app are also vital to be considered in terms of payment gateway implementation. Thus, selling digital content, your app should comply with App Store or Play Store purchase regulations. Gmail or Apple ID must be used while the transactions are performed.

Google and Apple also care about necessary instruments for developers and instructions to them. For instance, iOS developers have a special framework recommended by Apple. Android devs also use a particular API for building apps. As a result, the App Store or Google Play will handle all transactions.

But in case you're selling something physical, both platforms encourage using mobile payment gateway providers. A payment gateway also uses specific APIs to connect to your application.

Certificates of Security

PCI DSS certification is required when dealing with client financial data. Even if you use a very secure gateway, apply for a security certificate.

To obtain certificate, you must go through a complex verification process. First off, your data system containing customer credit card information should be PCI DSS compliant. Then, the vulnerabilities found by pentesters need to be resolved. After all of the adjustments have been completed, you’ll be thoroughly examined by one of the Qualified Security Assessor organizations.

Providers of Payment Gateways

Having learnt more about security certificates and merchant accounts, let’s look at the most popular payment gateways you can use.

PayPal

PayPal is undoubtedly the most well-known payment gateway service, known as a hosted payment solution used by 360 million customers from over 200 countries. PayPal Payments Pro and PayPal Express Checkout are two other services it offers.

Braintree

PayPal has a subsidiary called Braintree. This mobile payment service has built-in fraud prevention, two-day payments, and live customer service. Braintree also provides buyers with individual merchant accounts, being available in 40 countries. This payment gateway includes software development kits (SDK) in seven programming languages, as well as compatibility for iOS and Android.

Stripe

Among other features, Stripe offers authorization, mobile and desktop checkout, as well as analytics. Stripe.js, the organization's secure transmission standard for web building, is the most intriguing functionality. Stripe has SDKs available in seven different programming languages. So integrating Stripe's API into your project isn't an issue.

Authorize.net

It’s one of the most trusted payment gateways in the United States and Canada. They offer a Payment Gateway Only plan if you already have a merchant account or wish to use your own supplier.

Authorize.net's gateway software also provides built-in fraud detection, information management, recurring billing, and PCI DSS compliance with the help of its tokenization technology.

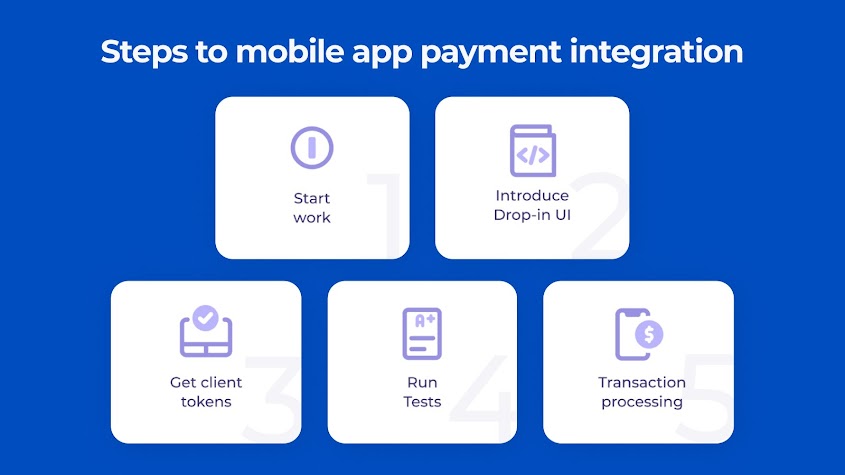

The Process of Integrating a Payment Gateway into a Mobile App

We used the Braintree service to illustrate establishing a payment gateway solution for iOS-based products. The processes for integrating a payment gateway into an Android app are the same. The only distinction is that software developers must apply the Braintree library specifically for the Android SDK configuration.

1. Get to work. Programmers must integrate Braintree into the project using build systems like CocoaPods, Swift Package Manager, etc.

2. Demonstrate the Drop-in User Interface. Create a bespoke user interface and tokenize credit card data directly.

3. Compile a list of client tokens. You'll need to acquire a client token from your server, which will be produced depending on the request from your app. Every time your program is restarted, create new client tokens.

4. Examine how well the integration works. Use Braintree test card data and single-use numbers to execute tests.

5. Handling of transactions. Use your server's one-time payment option when completing a transaction.

Integration of a Payment Gateway for Direct Credit/Debit Cards

Customers can use the mobile app API to perform money transactions using debit/credit cards. API or HTTPS inquiries are used to process payments.

Let's take a closer look at such integration’s essential characteristics.

- The UX and UI of the payment process are ultimately monitored by the merchants. They also need to control data security and obtain PCI DSS certification.

- This integration may be used on various mobile devices (smartphones, tablets, etc.).

- Purchasers may buy and pay for items without having to leave your app.

SDK Integration in an Application

Each vendor has their own SDK set. You can usually discover them on your payment gateway provider's official website. Using SDKs means you will be less vulnerable to be PCI compliant.

A mobile payment gateway integration necessitates the use of the technologies listed below during completing software development services:

- React

- JavaScript

- Redux

- PHP

- Python

- Ruby, etc.

API connectivity is also required for payment processing in iOS and Android mobile apps. Each payment provider has its own API, and one the software developers should use is determined by the client's payment gateway solution. Braintree, for instance, takes advantage of GraphQL and REST APIs.

Your team will have to engage with platform-specific payment gateway solutions in case you decide to work in Digital Commerce which is the largest part of the world market selling online content. Apple Pay for iOS and Google Pay for Android are the appropriate options for that.

Wrapping Up

A gateway implementation into a mobile app has many pitfalls you should know to provide your clients with seamless payment services. You can make your job easier and apply to a skillful software development team for a consultation. The specialists will answer the most disturbing business questions you have and help you build a modern and competitive app with flawlessly working payment gateway integrations.

0 Comments